With recent economic turbulence, the words “down round” are appearing more in mainstream business news articles, mentioning down rounds for companies such as Klarna or Instacart. But what exactly is a down round and how can you avoid it?

Rapidly growing companies often depend on external investment to fund their growth. Investment can arrive in successive rounds to match the phases of growth. In the ideal scenario, follow-on rounds are priced at higher valuations, reflecting the growth of the company. This is a happy situation for existing investors because the value of their investment is increasing. However, there are cases where the company must seek more funding at a valuation lower than the previous round. This is called a “down round”, meaning the price is down on previous rounds, rather than up. This can be due to multiple reasons, such as the company not reaching its targets, overvalued previous investment rounds or an adverse shift in market sentiment.

How can the value be lower?

The valuation of a company is due to multiple factors. Internal factors include profitability, company size, growth, assets and special talent. External factors take in elements such as market attractiveness, industry competition, investor appetite and easy availability of financing. Based on combinations of these and other factors, a company’s valuation can rise or fall.

The company may seek funding to match its growth ambitions or because it has run out of funds before achieving its intended goals. If the timing of the investment round occurs when the value of the company has fallen, the company may have to take on new investment at a lower valuation than in the previous round of funding. This is called a “down round”.

Is a down round a bad thing?

In business, signals are important.

It is always exciting to be able to tell a growth story. Growth stories bring optimism. Everybody wants to associate with a company that is “going places.” Employee morale is high – it is easier to attract and retain top talent. It is easier to make cooperative partnerships. Investors all want to jump onboard before the value rises more.

For the company management, it is hard to admit that the valuation is lower than during the previous round. A down round can damage employee morale and may make it difficult to retain talent. Falling valuations will make it harder to attract more investment.

And it will lead to uncomfortable conversations with existing investors. Especially investors who put their faith in the company from the early days.

Klarna has become the poster boy of news items on down rounds, when they have dropped their valuation to one seventh from a high of $45.6 billion in June 2021 to $5.6 billion now. The most common verb in these pieces is “slashed”. Some articles are questioning if such a cut will even be enough to attract more investors.

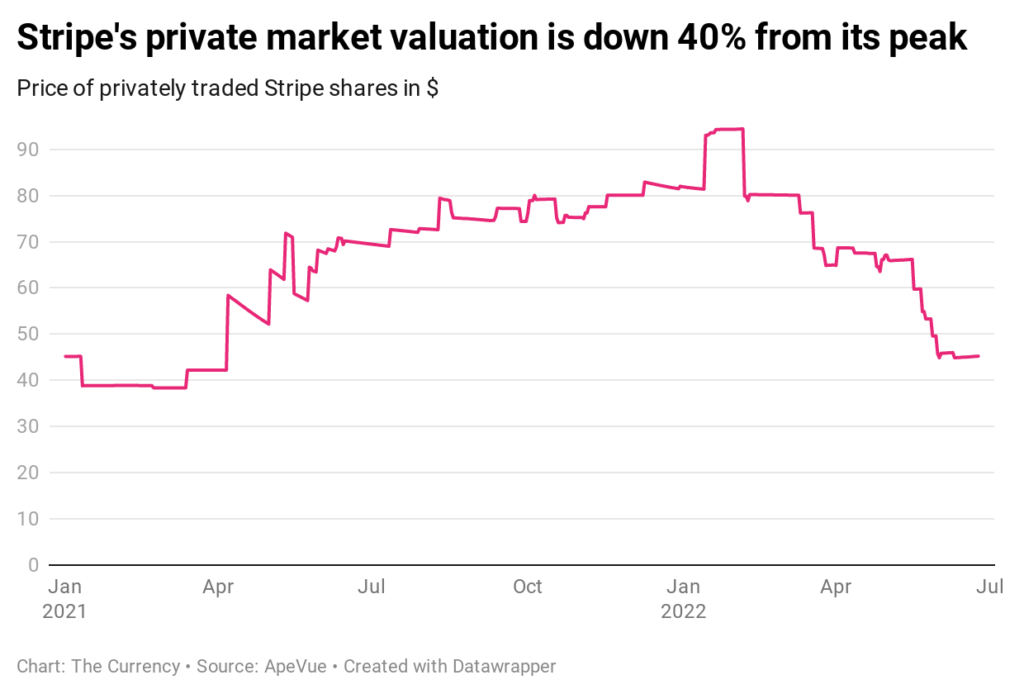

Payments company Stripe had previously reached a valuation of $95 billion in its last funding round in March 2021. This had the company within sight of a hectocorn valuation (exceeding $100 billion). However, Stripe has seen their private market value reduced by some 40% on secondary markets between January and June of 2022.

This has caused the company to mark down its internal share price from $40 to $29, according to the Wall Street Journal.

What does a down round mean to existing investors?

The most recent price of a funding round is a reliable indicator of market value of a company. When each successive new round is priced higher, existing investors are reassured by the progressive increase in the value their investment. Conversely, when there is a down round, the market value of the shares is reduced to a level that may be below the levels achieved in earlier rounds. This means that investors will have to revalue their existing holdings downwards.

In this situation, existing investors can take the opportunity to participate in the new down round to acquire more shares at a lower pricing than their original shares. Whether the earlier investors participate in this new round or not, they will find their original investment diluted by the new investment.

What are the alternatives to a down round?

If your company needs funds, you have some alternatives other than seeking investment at a lower price. These can include:

- Cutting costs

- Debt finance

- Asset sale and leaseback

- Renegotiation with existing investors and loan note holders

- IP-based financing

- Closing down the company

Cutting costs can reduce the “burn rate” – the amount of money you spend on developing the business – and thereby extend the “runway” – the amount of time the company can continue with existing funding before needing to get more finance. In this way, you can defer the time from when you will need new investment.

Debt finance is a way of borrowing money without having to give shares. However, such finance depends on having a good credit rating and the availability of assets to secure the debt. Invoice factoring can allow your company to “sell” invoices that are due at a later date and receive up-front financing. Debt finance can carry high interest rates, which will impose an additional cost burden. Furthermore, the financing conditions can also mean that the debtor can often call in the debt at the worst time for your business.

For companies that own property such as buildings or production equipment, one financing option is to sell the assets to gain short-term cash. They can then lease them from the new owners to spread the cost burden over a longer period of time.

If you have a good relationship with investors and loan note holders, you may be able to negotiate assistance and forbearance in restructuring the business. This may defer the down round or reduce the need for further funding.

Another alternative is to use your company’s intellectual property as a way of funding the business and putting off the necessity for a down round. This is often an overlooked option.

In the end, one way to avoid going to the market for more funding is to close the company down. This is often the last resort, but might be the the most logical option.

Hold on a second! How does the IP piece work?

Your invisible assets could be your best friend in your time of need. Do not simply view your IP as a way to prevent rivals copying your offering. If you take this view you will miss out on many other opportunities to take advantage of your hard-won assets.

Because companies rarely show all of their intangible assets on a balance sheet, it can be surprising to discover that you can convert these previously-invisible assets into cash on your balance sheet or income for your company.

There are several ways to get a second life for underutilised assets.

Here are just a few:

- You can divest non-core assets by selling them on the open market. This will bring in funds and it will save you on paying any further maintenance costs on the assets – a double benefit.

- If you are unable to find any buyer for some assets, you can still abandon them to save on ongoing maintenance costs.

- You may have non-core IP assets that you could license out to companies that do not compete directly. The royalty streams would bring in small amounts of income for otherwise unused assets.

- If you are more adventurous, you could license out some of your key IP assets even to your rivals. Don’t forget that this IP tends to be much more valuable. Furthermore, your competitors are in the best position to make the most of those assets, so they can pay considerable royalties.

- If you identify anyone infringing on your IP, you can pursue them for infringement. There are several IP litigation funds who can arrange financing for such a campaign.

- In the past, banks would only finance loans if there was security available in the form of physical property. In this IP-intensive age, many high-tech companies have few tangible assets (if any). Several banks are now offering to finance companies and will accept intangible assets as security. Please contact us if you need help with this.

- Just like the sale-and-leaseback for physical property, you can sell your IP and get the rights back to practice it yourself. You can work with a firm that commercialises IP. They can offer an upfront payment or share the royalty stream from a successful licensing campaign. This can bring an income from your previously-invisible assets. With the correct accounting treatment, you can recognise this new stream of income as revenue.

This article is just an introduction to the topic. If you would like to get more information tailored to your specific circumstances, you can click here to request a free IP coach review.

About the author:

Raymond Hegarty is an IP strategist, author and speaker. He is an IP coach to CEOs and CFOs of high-growth technology and life science companies.

He is the author of three bestselling books on IP strategy and has spoken to tens of thousands of people on topics of innovation and intellectual property. IAM Magazine has recognised him as one of the world’s top 300 IP strategists every year for the last 10 years.

He is the CEO of IntaVal, a leading global IP strategy consultancy.