All bad news for founders?

If you are a founder looking for investment, it is hard to keep your chin up with the barrage of news articles about investment slowdown. Can there be any good news for founders? (Spoiler alert: there is good news!)

Articles talk about down rounds. They talk about investment multiples being down. Even with lower multiples, the investment is shifting from multiples of ARR (annual recurring revenue) to multiples of profitability. And furthermore, the international environment may mean that those profits may be under pressure too.

Look at it from the viewpoint of investors

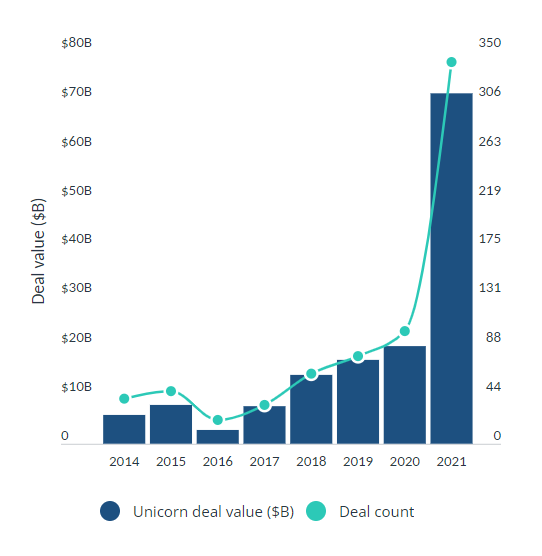

Even with a pandemic (or in some cases because of the pandemic), investment levels were very buoyant through 2021. In 2021, the value of Unicorn deals was more than triple the level in 2020 (insert pitchbook link ).

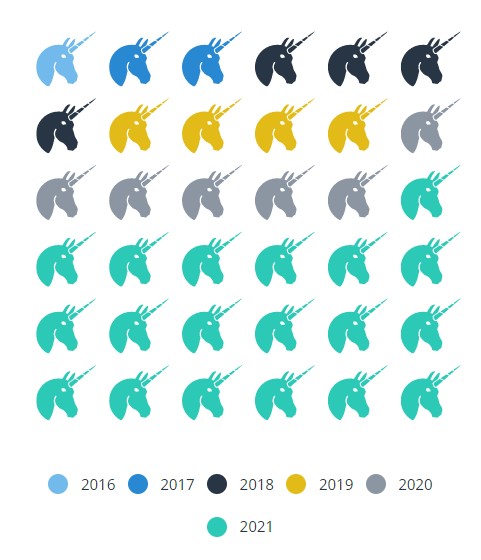

Indeed, more unicorns emerged in 2021 than the total of the previous 5 years.

Some would even call it a frenzy. The heady environment drove investors to continue making rapid decisions to avoid missing out on “hot” stocks. Often, they did not have time to vet companies or build relationships with founders. The impact of this was rapid decisions, increasing multiples and limited vetting.

Macro environment leading to investment slowdown

In the first quarter of 2022, it felt like a switch was flipped. Here are some features:

- War in Eastern Europe

- Rising fuel prices

- Food supplies threatened

- Post-pandemic supply chains disrupted

- National protectionism threatening global trade

- Climate change driving policy changes

- Inflation

- Interest rate increases

What it all means for the investment environment

Despite all of the apparent success stories in past years, fundraising is never easy. However, in comparison with the loose availability of funding in recent years, there are some big changes in the investment environment:

- The frenzy is over. Investors are not outbidding each other.

- There are waves of press pessimism. Each new negative story is seized upon to add to the cumulative gloomy narrative.

- The current era of free money is over.

- Multiples are falling.

- Inflation will squeeze profitability. This is a double punch – the reduced multiples will be calculated based on reduced profitability.

And it is a vicious cycle. The worse expectations are, the worse it gets.

So, what is the good news?

Here are 11 reasons why this investment slowdown is good news:

- For investors, it is time to take a pause. The hysteria to invest was exhausting. The flipside of FOMO (fear of missing out) is FOMU (fear of messing up) – making a disastrous decision under pressure.

- The money has not gone away. We have been hearing about how “dry powder” has continued to accumulate over the past decade. This dry powder is still looking for good places to be deployed.

- After taking a pause, investors are returning to the market to see if this new environment has revealed any new opportunities.

- VC still have incentives to commit capital. Management fees are usually a percentage of capital deployed. VCs depend on these fees to run their operations. If they give back the uninvested money to their LPs, they will have to forfeit the management fees.

- The bottom line is that investors still want to invest in quality companies. If you believe your company is outstanding, then you will be “the one” for them.

- Investment can set you apart from the field. You can rest assured that your mediocre competitors are not going to get funded, simply because there is a “buzz” in your field.

- This pause also means that investors will have more time to get to know the principals and build relationships.

- You will also get the chance to evaluate which investors are the best fit for you. As you know, not all money has the same quality.

- Investors who stick with you in tough times will be excellent partners at better times in the future.

- Due diligence will get tougher. Surviving a rigorous due diligence is not just about passing the exam. It is also a health check on how sustainable your business will be in the long term.

- Any financing decision now will be based on recognition of your undeniable quality, not some rosy view in an investment flurry. This careful decision also means that you are less likely to go through the future pain of a down round.

What should you do now?

Here are four things you can do now to address this investment slowdown:

- Prepare for the long haul. Investment always takes longer than anticipated.

- Reduce your burn rate. This will show investors that you handle funds prudently, it lengthens your runway and it gives better profit figures on which to base a multiple.

- Start preparations earlier. Assume your funding round could take 9 months and you may need to start your own preparation 9 months ahead of that. Don’t start when you just have 2 months of runway left. If you have the luxury of a long runway, start getting into good shape now and give yourself 9-18 months to get ready.

- Engage an IP coach early in the process to build a solid foundation. Investors and their advisors are getting more thorough about due diligence. In companies where 90% of the value may be intangible, 90% of the risks may also be intangible. Lawyers and investment bankers are getting smarter about intangible due diligence. Even if you had a light-touch previous investment round, expect the next grilling to be more rigorous.

About the author:

Raymond Hegarty is an IP strategist, author and speaker. He is an IP coach to CEOs and CFOs of high-growth technology and life science companies.

He is the author of three bestselling books on IP strategy and has spoken to tens of thousands of people on topics of innovation and intellectual property. IAM Magazine has recognised him as one of the world’s top 300 IP strategists every year for the last 10 years.

He is the CEO of IntaVal, a leading global IP strategy consultancy.